In an unexpected turn of events, Japan finds itself grappling with recessionary woes, relinquishing its long-held status as the world’s third-largest economy to Germany. This economic upheaval raises questions about the trajectory of Japan’s monetary policy and its ability to navigate turbulent global markets.

Japan’s descent into recession comes as a surprise to many, with weak demand in China, sluggish consumption, and production halts at major corporations like Toyota Motor Corp contributing to the downturn. Analysts warn of further contraction in the current quarter, painting a challenging path to recovery for the island nation.

“What’s particularly striking is the sluggishness in consumption and capital expenditure that are key pillars of domestic demand,” remarked Yoshiki Shinke, senior executive economist at Dai-ichi Life Research Institute. “The economy will continue to lack momentum for the time being with no key drivers of growth.”

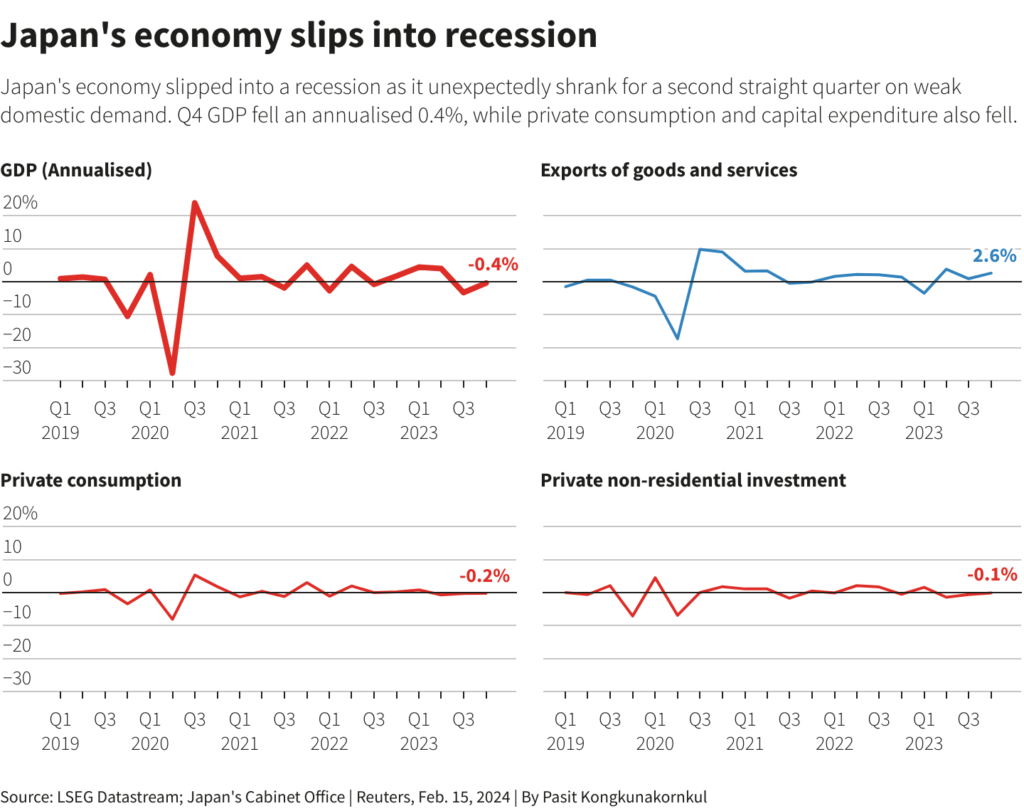

Official data revealed that Japan’s gross domestic product (GDP) fell an annualized 0.4% in the October-December period, following a 3.3% slump in the previous quarter. These consecutive quarters of contraction meet the technical definition of a recession, sparking concerns about the nation’s economic health.

While many anticipate the Bank of Japan (BOJ) to phase out its extensive monetary stimulus in the coming year, the bleak economic data casts doubt on the feasibility of such a move. Rising wages were expected to bolster consumption and maintain inflation around the BOJ’s 2% target, but the recent downturn complicates this narrative.

Stephan Angrick, senior economist at Moody’s Analytics, expressed skepticism about the possibility of a rate hike in this climate. “Two consecutive declines in GDP and three consecutive declines in domestic demand are bad news, even if revisions may change the final numbers at the margin,” he remarked. “This makes it harder for the central bank to justify a rate hike, let alone a series of hikes.”

Addressing the economic challenges, Economy Minister Yoshitaka Shindo emphasized the importance of solid wage growth to support consumption, which he noted was “lacking momentum” due to rising prices. However, the road ahead remains uncertain as policymakers grapple with the implications of Japan’s economic downturn.

The unexpected recession has also prompted a reshuffling of global economic rankings, with Germany surpassing Japan to become the world’s third-largest economy. Japan’s nominal GDP fell below that of Germany, signaling a significant shift in the global economic landscape.

Market reactions to Japan’s economic woes have been mixed, with the yen remaining steady and government bond yields falling. However, optimism about the BOJ’s commitment to keeping borrowing costs low has buoyed stock markets, with the Nikkei stock average rallying to 34-year highs.

Looking ahead, the BOJ’s next moves will be closely watched by investors and policymakers alike. While some analysts anticipate an early exit from ultra-loose policy measures, others remain cautious amid lingering economic uncertainties.

As Japan grapples with the challenges of recession and global economic realignment, the path to recovery remains uncertain. With pivotal decisions on monetary policy looming on the horizon, the nation faces a critical juncture in its economic journey.